This post may contain affiliate links. We may earn money or products from the companies mentioned in this post.

Back when I adopted Wally in early 2019, one of my first questions was “Can you get pet insurance for a rescue dog?”

Because here’s the thing, I had had medical dog insurance for my previous pups Missy & Buzz, but they had lived with me since they were 8 weeks old.

When I adopted Wally, he was already a year and a half, so I honestly wasn’t sure if I could still get coverage for him.

Well, turns out I could and I did, but there are several caveats to be aware of, and in this blog post, I’ll share them with you.

Spoiler alert: The pet insurance I got for him was through a pet insurance provider called Healthy Paws, and I’ll talk more about his plan and coverage later on in this blog post.

Understanding Pet Insurance

But first, let’s talk about what exactly pet insurance entails.

Well, as the name suggests, pet insurance is a type of medical coverage that helps offset the cost of veterinary care for your furry friend.

It typically reimburses you for a portion of the veterinary expenses incurred for your pet, including accidents, illnesses, and sometimes even routine care vet visits.

But just like human health insurance, pet insurance policies vary in terms of coverage, premiums, and deductibles.

Pet Insurance For A Rescue Dog

The good news is that pet insurance is generally available for rescue dogs as much as it’s available for dogs that come from breeders.

Whether you’ve adopted a rescue dog from a shelter or a breed-specific rescue organization, you can typically find insurance providers willing to cover them.

However, it’s important to note that some insurance companies may have specific restrictions or limitations, so it’s crucial to do your research and choose the right policy for your dog’s unique needs.

Factors to Consider When Researching Pet Insurance For A Rescue Dog

When you’re doing your homework as far as browsing pet insurance for a rescue dog, there are a few factors to keep in mind:

Pre-Existing Conditions

When it comes to pet insurance, coverage for pre-existing conditions can vary significantly among insurance providers.

While some insurers may exclude all pre-existing conditions, others may offer coverage for certain conditions depending on their curability such as:

- Ear Infections

- Urinary Tract Infections (UTIs)

- Skin Allergies

- Mild Digestive Issues

- Curable Injuries

So if, for example, your dog had a previous fracture that has fully healed and no longer requires ongoing treatment, some insurance providers may consider it a curable pre-existing condition and provide coverage for any potential future related incidents.

Age Restrictions

Some insurance companies have age restrictions, limiting coverage for older dogs.

So if you adopt a senior dog, it’s crucial to find an insurer that offers coverage regardless of age.

3 examples of pet insurance companies that don’t have age restrictions are:

However, the monthly premium is considerably higher for older dogs than it is for younger ones.

Especially if they haven’t been insured with the company since they were young pups, so that’s something to be aware of.

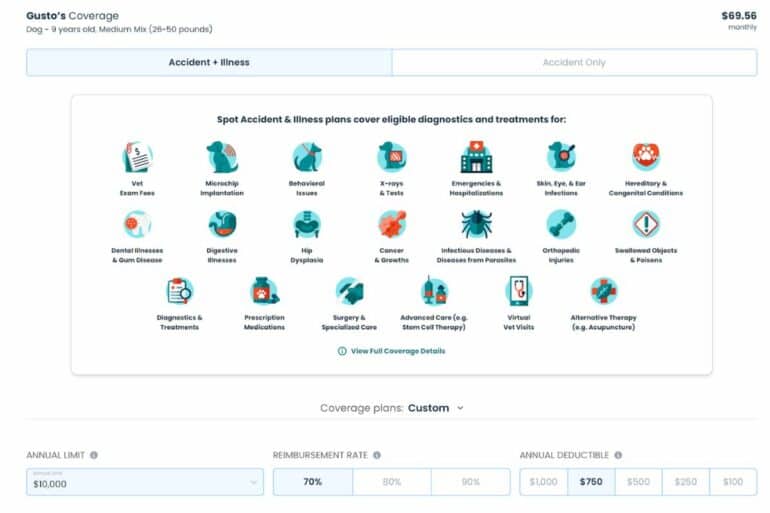

Just out of curiosity, I pretended to have a mixed breed, 9 year old male dog who weighs between 31-50 lbs.

I called him Gusto and compared Figo, Spot, and Embrace insurance rates with the following criteria for my monthly premiums:

- Zip code: 27614 (Raleigh, NC)

- 70% reimbursement

- $750 annual deductible

- $10,000 annual reimbursement limit

Here are the results:

Figo would charge me $43 per month:

Spot would charge me $69.56 per month:

Embrace would charge me $55.77 per month:

Now, if Gusto was 2 years old, here’s what his rates would look like with the same criteria (70% reimbursement, $750 annual deductible, $10k annual limit):

- Figo would charge $14.93 compared to the $43 if Gusto was 9 years old.

- Spot would charge $27.43 compared to the $69.56 if Gusto was a senior pup.

- Embrace would charge $33.04 compared to the $55.77 for senior Gusto.

So on average, it’s about 44% more expensive to insure an older dog than it is to ensure a younger one.

Definitely something to be aware of!

Breed-Specific Conditions

Something else to be aware of when you’re looking for pet insurance for a rescue dog are breed-specific conditions.

Because not all pet insurance providers cover all health issues that certain breeds may be prone to.

For example:

- Bulldogs. Bulldogs are prone to various health issues, including breathing difficulties due to their brachycephalic (short-nosed) anatomy. They are also susceptible to skin infections, hip dysplasia, and eye problems such as cherry eye and corneal ulcers.

- Labrador Retrievers: Labradors are prone to obesity, which can lead to various health complications such as joint problems, diabetes, and heart disease. They’re also susceptible to hip and elbow dysplasia, as well as certain eye conditions like cataracts and progressive retinal atrophy (PRA).

- German Shepherds: GSDs are predisposed to hip and elbow dysplasia, as well as degenerative myelopathy, a progressive neurological disorder. They can also develop digestive issues such as exocrine pancreatic insufficiency (EPI) and bloat, a potentially life-threatening condition.

- Golden Retrievers: Goldens are prone to various types of cancer, including lymphoma, hemangiosarcoma, and mast cell tumors. They’re also at a higher risk for hip and elbow dysplasia, as well as heart conditions like subvalvular aortic stenosis and dilated cardiomyopathy.

- Dachshunds: Doxies are susceptible to intervertebral disc disease, a spinal condition that can cause paralysis. They’re also prone to obesity, dental issues, and eye problems such as progressive retinal atrophy (PRA) and glaucoma. Additionally, their long backs make them more susceptible to injuries and conditions like patellar luxation.

Hip dysplasia and certain types of cancer are probably the most regulated illnesses as far as coverage by pet insurance providers is concerned.

So make sure that the insurance policy you choose covers any conditions your rescue dog may suffer from, especially if they’re a particular breed.

Coverage Options & Waiting Periods

Consider what type of coverage you want for your rescue dog.

Different plans offer varying levels of coverage, including:

- Accident-only

- Illness-only

- Comprehensive accident & illness coverage

- Optional add on: routine care

Most pet insurance providers also have waiting periods.

That means that coverage for accidents and/or illnesses doesn’t start until the waiting period is over.

Waiting periods are typically anywhere between 7 days to 30 days.

Do They Pay The Vet Directly?

Something else to keep in mind is that many pet insurance providers don’t pay the vet directly!

So you’ll have to cover the cost of your rescue pup’s veterinary treatment up front, and will get reimbursed later.

However, there are a few pet insurance providers that have the option of paying the vet directly, for example:

Quick Claims Process & Timely Reimbursement?

If you live paycheck to paycheck, it can be challenging to front the payment on a steep vet bill.

That’s why it’s good to know how long a pet insurance provider takes on average to process claims and reimburse you.

A good way of finding out is by reading customer reviews!

From experience, PetsBest and Healthy Paws reimbursed me within 7-10 business days after I submitted my claims.

That was really good news as PetsBest covered thousands of dollars in cancer treatment costs for my late girl Missy.

I only had to use Healthy Paws twice for Wally, and they also reimbursed me fairly quickly.

Note: I had set up direct deposit for both which works a lot faster than if you’re getting a check.

The Pet Insurance I Got For My Rescue Dog

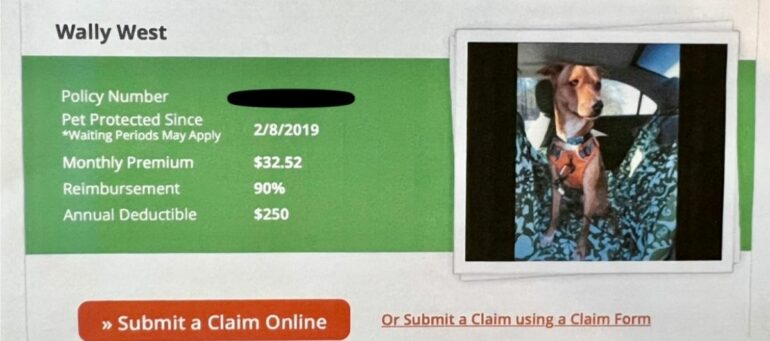

I already briefly mentioned that I got pet insurance for Wally through Healthy Paws.

When I insured him, he was a little over 1.5 years young and his monthly premium was $32.52.

I chose a reimbursement level of 90% and an annual deductible of $250.

The plan I had did not have an annual reimbursement limit, but it had a waiting period of 15 days before they processed any claims.

This was back in 2019.

After my move overseas to Germany with Wally in 2021, I was obviously no longer eligible for pet insurance through Healthy Paws, and had to go with a German pet insurance provider instead.

That said, I was curious to find out what the current rate for Wally would be with Healthy Paws in 2023, and these days it would be $57.42 per month.

That’s a difference of $25 which is quite a bit, but ultimately understandable with the increased inflation and different economic parameters.

Wally’s pet insurance with Healthy Paws in 2019

Benefits of Pet Insurance for Rescue Dogs

Now, having pet insurance for your rescue dog can offer numerous benefits:

Financial protection is the most obvious benefit of having pet insurance.

Veterinary bills can quickly accumulate, especially if your rescue dog requires emergency care or treatment for a chronic condition.

Pet insurance provides a safety net, helping you afford the necessary medical expenses without breaking the bank.

Timely access to care

With pet insurance, you can make decisions based on your dog’s needs rather than financial constraints.

You won’t have to delay treatment or compromise on quality care due to cost concerns.

Peace of mind

Knowing that you have insurance coverage for your rescue dog can alleviate the stress and worry associated with unexpected medical expenses.

Bottom Line

So, can you get pet insurance for a rescue dog?

Yes, you can!

A huge plus is certainly that pet insurance coverage provides peace of mind and financial assistance when unexpected medical expenses arise.

However, make sure that you compare available plans from different pet insurance providers, as their rates can vary quite a bit.

Factors to take into consideration are:

- Various coverage options (deductible, reimbursement percentage)

- Pre-existing and breed-specific conditions

- Waiting periods before coverage begins

- Options of direct payments to the vet

- Potential age restrictions

- Reimbursement time

Also, I figure it’s worth mentioning that an alternative to pet insurance for a rescue dog is a savings account that you only use for vet related expenses.

So instead of paying a monthly premium to a pet insurance provider, deposit that monthly “payment” into the savings account.

The downside of this approach is that it’ll take a little while to get up to a healthy cushion.

For example, if you’d only deposit $50 on a monthly basis, it would take 20 months to turn into $1,000 you could put towards an expensive vet bill.

That’s almost 2 years!

All that said, make sure to weigh the pros and cons before you go with either option.

Now we’d love to hear from you in the comment section below – did you get pet insurance for a rescue dog?

Which provider did you end up choosing, and how old was your rescue pup when you signed them up?

Save To Pinterest

Top Picks For Our Puppies

- BEST PUPPY TOY

We Like: Calmeroos Puppy Toy w/ Heartbeat and Heat Packs – Perfect for new puppies. Helps ease anxiety in their new home. - BEST DOG CHEW

We Like: Mighty Paw Naturals Bully Sticks – All of our puppies love to bite, nip, and chew. We love using Bully Sticks to help divert these unwanted behaviors. - BEST DOG TREATS

We Like: Crazy Dog Train-Me Treats – We use these as our high-value treats for our guide dog puppies. - BEST FRESH DOG FOOD

We Like: The Farmer’s Dog – A couple months ago we started feeding Raven fresh dog food and she loves it! Get 50% off your first order of The Farmer’s Dog.

Check out more of our favorites on our New Puppy Checklist.